Prime Checking includes benefits that allow you to save on transactions and get more for your money where it matters most.

Get a Relationship Interest Rate on eligible linked CDs and savings accounts ,

Pay no fees for select banking services, such as incoming wire transfers , ,

Save with a relationship discount

We waive our fees and reimburse some or all fees charged by non- Wells Fargo ATMs. ,

Relationship Interest Rates, ATM fee waivers, and discounted banking services ,

| Balance | Standard Interest Rate | Annual Percentage Yield (APY) |

|---|---|---|

| $0 or more | 0.01% | 0.01% |

The Annual Percentage Yield (APY) is a percentage rate that reflects the total amount of interest paid on the account, based on the interest rate and the frequency of compounding for a 365-day period (366 in a leap year).

$25 monthly service fee can be avoided with $20,000 or more in statement-ending qualifying balances in your linked accounts.

For balances above $250,000, consider a Wells Fargo Premier Checking account with our premier level of relationship banking benefits.

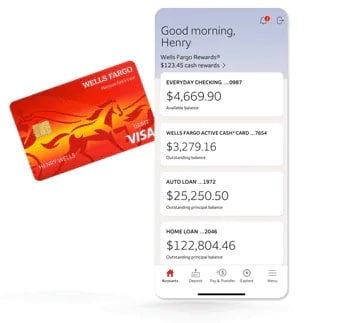

4.9/5 Stars on the App Store and 4.8/5 Stars on Google Play as of March 5, 2024

Skip the lines and deposit checks right from your smartphone

Add debit and credit cards to your mobile device to tap and pay

Send and receive money in minutes

Pay bills from nearly anywhere

Sign on to the mobile app with your fingerprint or face

Turn credit and debit cards on or off

Screen image is simulated.

Online banking with all the banking tools you need

Contactless debit card for fast, secure payments and Wells Fargo ATM access

Approximately 11,000 Wells Fargo ATMs to help you bank locally and on the go

24/7 fraud monitoring plus Zero Liability protection

From Wells Fargo Advisors

Get a discount of 0.05% off the 0.35% advisory fee , , for Intuitive Investor ® from Wells Fargo Advisors. You'll get a diversified portfolio, combining tech-enabled investing with the help you need, when you need it.

Investment products and services are offered through Wells Fargo Advisors. Wells Fargo Advisors is a trade name used by Wells Fargo Clearing Services, LLC (WFCS) and Wells Fargo Advisors Financial Network, LLC, Members SIPC, separate registered broker-dealers and non-bank affiliates of Wells Fargo & Company. WellsTrade investment accounts and Wells Fargo Advisors Intuitive Investor investment accounts are offered through WFCS.

Wells Fargo can connect you to professionals who will work with you to help build a customized plan for the future you want. Your financial professional can offer personalized guidance based on your specific needs and goals.

Avoid the $25 monthly service fee with $20,000 or more in statement-ending qualifying balances in your linked Wells Fargo consumer deposit accounts and investment accounts.

Deposit account balances include:

Investment account balances include:

Investment products and services are offered through Wells Fargo Advisors. Wells Fargo Advisors is a trade name used by Wells Fargo Clearing Services, LLC (WFCS) and Wells Fargo Advisors Financial Network, LLC, Members SIPC, separate registered broker-dealers and non-bank affiliates of Wells Fargo & Company.

You can apply online or in person:

You can avoid the $25 monthly service fee with $20,000 or more in statement-ending qualifying balances in your linked accounts.

Enroll in Wells Fargo Online from your desktop or mobile device for secure online access to your accounts. Once you've enrolled, you'll receive an email confirmation, and you'll be ready to sign on and manage your accounts.

Switch your Wells Fargo checking account

No need to change your account number. You'll just need to connect to a banker to get started. Contact us at 1-800-869-3557 .

(A) If your Prime Checking or Premier Checking account is converted to another checking product or closed by us or you, all linked accounts are delinked from the Prime Checking or Premier Checking account and effective immediately, benefits no longer apply, including benefits to your now delinked accounts. You'll no longer receive discounts, options to avoid fees on other products or services, or the Relationship Interest Rate; for time accounts (CDs), this change will occur at renewal. Your delinked accounts will revert to the Bank's current applicable interest rate or fee at that time. (B) If you or we delink an account from your Prime Checking or Premier Checking account but other accounts remain linked, the loss of all benefits and the other consequences described above in (A) will immediately apply to the delinked account. Benefits available to your Prime Checking or Premier Checking account and any remaining linked accounts will continue.

Relationship Interest Rate is variable and subject to change at any time without notice, including setting the interest rate equal to the Standard Interest Rate or to zero (0.00%), which could change the Relationship Annual Percentage Yield (APY). For CDs, the change will occur upon renewal. To receive a Relationship Interest Rate/Relationship APY, the eligible savings account or CD must remain linked to a Prime Checking, Premier Checking or Private Bank Interest Checking account. Upon linking, it may take up to two business days for the Relationship Interest Rate to be applied to your eligible savings account. CDs must be linked at account open and/or at every renewal.

In addition to any applicable fees, we make money when we convert one currency to another currency for you. The exchange rate used when we convert one currency to another is set at our sole discretion, and it includes a markup. The markup is designed to compensate us for several considerations including, without limitation, costs incurred, market risks, and our desired return. The applicable exchange rate does not include, and is separate from, any applicable fees. The exchange rate we provide to you may be different from exchange rates you see elsewhere. Different customers may receive different rates for transactions that are the same or similar, and the applicable exchange rate may be different for foreign currency cash, drafts, checks, or wire transfers. Foreign exchange markets are dynamic and rates fluctuate over time based on market conditions, liquidity, and risks. We're your arms-length counterparty on foreign exchange transactions. We may refuse to process any request for a foreign exchange transaction.

Unless otherwise noted, stated benefits apply only to the Prime Checking account and not other linked accounts.

Incoming wire transfers received in a foreign currency for payment into your account will be converted into U.S. dollars using the applicable exchange rate without prior notice to you. For more information, see the "Applicable Exchange Rate" section of the Deposit Account Agreement.

All loans are subject to application, credit qualification, income verification and, if applicable, collateral evaluation. Programs, rates, terms, and conditions are subject to change without notice. The interest rate discount requires a qualifying Wells Fargo consumer checking or savings account and automatic payments set up from qualifying Wells Fargo checking or savings account. If automatic payments are canceled, for any reason at any time, after account opening, the interest rate and the corresponding monthly payment may increase. Only one interest rate discount may be applied per application. Talk with your banker, or refer to product information online at wellsfargo.com/relationshipdiscount, to learn what requirements apply to your specific loan.

Fees charged by non-Wells Fargo ATM operators or networks may apply. For Prime Checking and Premier Checking accounts, Wells Fargo will waive its non-Wells Fargo ATM cash withdrawal transaction fee (U.S. and international) when you withdraw cash from a non-Wells Fargo ATM. In addition, for Prime Checking Wells Fargo will reimburse one fee charged by a non-Wells Fargo ATM operator located in the U.S. and one fee charged by a non-Wells Fargo ATM operator located outside the U.S. per fee period. For Premier Checking, Wells Fargo will reimburse all fees charged by non-Wells Fargo ATM operators. When the amount of the fee charged by the non-Wells Fargo operator or network is not provided to Wells Fargo, Prime Checking and Premier Checking customers will receive a $4.00 reimbursement per cash withdrawal.

Outstanding Cashier's checks are subject to state or territorial unclaimed property laws.

If the cashier's check is lost, stolen, or destroyed, you may request a stop payment and reissuance. A stop payment and reissuance can only be completed within a branch location. As a condition of stop payment and reissuance, Wells Fargo Bank will require an indemnity agreement. In addition, for cashier's checks over $1,000.00, the waiting period before the stop payment and reissuance of an outstanding cashier's check may be processed is 90 days (30 days in the state of Wisconsin and 91 days in the state of New York). The waiting period can be avoided with the purchase of an acceptable surety bond. This can be purchased through Wells Fargo's approved insurance carrier or through an insurance carrier of the customer's choice. The cost of a surety bond varies depending on the amount of the bond and the insurer used. Surety bonds are subject to the insurance carrier's underwriting requirements before issuance. If the surety bond is not provided, the waiting period applies.

The benefit applies to the exchange rate for foreign currency purchases, when you purchase foreign currency through the Wells Fargo Foreign Currency call center, online at wellsfargo.com, or through a Wells Fargo branch. You'll also receive the benefit when you purchase or sell foreign currency at a Wells Fargo branch. This benefit applies only to foreign currency cash. It does not apply to foreign currency drafts, checks, or wire transfers. In addition to any applicable fees, we make money when we convert one currency to another currency for you. The exchange rate used when we convert one currency to another is set at our sole discretion, and it includes a markup. The markup is designed to compensate us for several considerations including, without limitation, costs incurred, market risks, and our desired return. The applicable exchange rate does not include, and is separate from, any applicable fees listed in the Consumer Schedule. The exchange rate we provide to you may be different from exchange rates you see elsewhere. Different customers may receive different rates for transactions that are the same or similar, and the applicable exchange rate may be different for foreign currency cash, drafts, checks, or wire transfers. Foreign exchange markets are dynamic and rates fluctuate over time based on market conditions, liquidity, and risks. We're your arms-length counterparty on foreign exchange transactions. We may refuse to process any request for a foreign exchange transaction.

The contents of a safe deposit box are not insured by the FDIC or by Wells Fargo Bank, N.A.

To insure the contents of your box, purchase an appropriate policy from the insurance company of your choice.

Mobile deposit is only available through the Wells Fargo Mobile ® app on eligible mobile devices. Deposit limits and other restrictions apply. Some accounts are not eligible for mobile deposit. Availability may be affected by your mobile carrier's coverage area. Your mobile carrier's message and data rates may apply. See Wells Fargo’s Online Access Agreement and your applicable business account fee disclosures for other terms, conditions, and limitations.

Terms and conditions apply. Some (but not all) digital wallets require your device to be NFC (Near Field Communication) enabled and to have the separate wallet app available. Your mobile carrier’s message and data rates may apply.

Enrollment with Zelle ® through Wells Fargo Online ® or Wells Fargo Business Online ® is required. Terms and conditions apply. U.S. checking or savings account required to use Zelle ® . Transactions between enrolled users typically occur in minutes. For your protection, Zelle ® should only be used for sending money to friends, family, or others you trust. Neither Wells Fargo nor Zelle ® offers purchase protection for payments made with Zelle ® - for example, if you do not receive the item you paid for or the item is not as described or as you expected. Payment requests to persons not already enrolled with Zelle ® must be sent to an email address. To send or receive money with a small business, both parties must be enrolled with Zelle ® directly through their financial institution’s online or mobile banking experience. For more information, view the Zelle ® Transfer Service Addendum to the Wells Fargo Online Access Agreement. Your mobile carrier's message and data rates may apply. Account fees (e.g., monthly service, overdraft) may apply to Wells Fargo account(s) with which you use Zelle ® .

Certain devices are eligible to enable fingerprint sign-on. If you store multiple fingerprints on your device, including those of additional persons, those persons will also be able to access your Wells Fargo Mobile ® app via fingerprint when fingerprint is enabled. Your mobile carrier's message and data rates may apply.

Only select devices are eligible to enable sign-on with facial recognition. If you have an identical twin, we recommend that you use username and password instead of facial recognition to sign on. Your mobile carrier’s message and data rates may apply.

Turning off your card is not a replacement for reporting your card lost or stolen. Contact us immediately if you believe that unauthorized transactions have been made. Turning your card off will not stop card transactions presented as recurring transactions or the posting of refunds, reversals, or credit adjustments to your account. Any digital card numbers linked to the card will also be turned off. For debit cards, turning off your card will not stop transactions using other cards linked to your deposit account. For credit cards, turning off your card will turn off all cards associated with your credit card account. Availability may be affected by your mobile carrier’s coverage area. Your mobile carrier's message and data rates may apply.

With Zero Liability protection, you will be reimbursed for promptly reported unauthorized card transactions, subject to certain conditions. Please see the applicable Wells Fargo account agreement or debit and ATM card terms and conditions for information on liability for unauthorized transactions.

Investment products and services are offered through Wells Fargo Advisors . Wells Fargo Advisors is a trade name used by Wells Fargo Clearing Services , LLC (WFCS) and Wells Fargo Advisors Financial Network , LLC, Members SIPC, separate registered broker-dealers and non-bank affiliates of Wells Fargo & Company .

Certain investments and investment accounts are not eligible for linking.

For complete information on WellsTrade fees and commissions, refer to the WellsTrade Account Commissions and Fees Schedule. Schedule subject to change at any time.

Wells Fargo Bank, N.A. is a banking affiliate of Wells Fargo & Company. Investment products and services are offered through Wells Fargo Advisors. Wells Fargo Advisors is the trade name used by Wells Fargo Clearing Services, LLC (WFCS) and Wells Fargo Advisors Financial Network, LLC, Members SIPC, separate registered broker-dealers and non-bank affiliates of Wells Fargo & Company.

Wells Fargo Advisors Intuitive Investor investment accounts are offered through WFCS.

For complete information regarding fees, refer to the Intuitive Investor Account Fee Schedule.

The interest rates and Annual Percentage Yields displayed here are for the Wells Fargo Bank locations in the California counties of Alameda, Contra Costa, Marin, Napa, San Francisco, San Mateo, Santa Clara, Solano and Sonoma.

Current Deposit Rates for 09/14/2024 - 09/20/2024

The Annual Percentage Yield (APY) shown is offered on accounts accepted by the Bank and effective for the dates shown above, unless otherwise noted. Rates are variable and subject to change without notice.

Interest is compounded daily and paid monthly. The amount of interest earned is based on the daily collected balances in the account. Each tier described above reflects the current minimum daily collected balance required to obtain the applicable APY. When the rates offered within two or more consecutive tiers are the same, this disclosure shows those multiple tiers as a single tier. The specific individual tiers are described in the rate sheet for this account. A copy of the then-current rate sheet will be provided to you before you open your account or is available at any time upon request from a banker. Fees could reduce earnings on this account.

Apple, the Apple logo, Apple Pay, Apple Watch, Face ID, iCloud Keychain, iPad, iPad Pro, iPhone, iTunes, Mac, Safari, and Touch ID are trademarks of Apple Inc., registered in the U.S. and other countries. Apple Wallet is a trademark of Apple Inc. App Store is a service mark of Apple Inc.

Android, Chrome, Google Pay, Google Pixel, Google Play, Wear OS by Google, and the Google Logo are trademarks of Google LLC.

Zelle ® and the Zelle ® related marks are wholly owned by Early Warning Services, LLC and are used herein under license.

Deposit products offered by Wells Fargo Bank, N.A. Member FDIC.